The development status and market analysis of citric acid industry in China shows that the trend of outward export of the industry remains unchanged

1. Development overview of citric acid industry

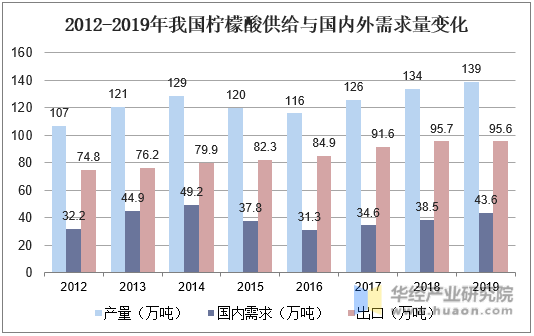

Citric acid is the first organic acid, because of physical properties, chemical properties, derivatives, is widely used in food, medicine, daily chemicals and other industries the most important organic acid. China is the world’s largest producer and exporter of citric acid products. But compared with Europe and the United States, China’s demand for citric acid products is not large, the annual consumption of only about 400,000 tons, the rest of the output is entirely dependent on export, so China’s citric acid product industry is an export-oriented industry, a great dependence on foreign markets. Data show that the citric acid industry has entered a capacity expansion cycle since 2016. In 2019, China’s output of citric acid reached 1.39 million tons, of which the domestic consumption was 436,000 tons, while the citric acid used for export reached 956,000 tons, accounting for 68.8% of the total output.

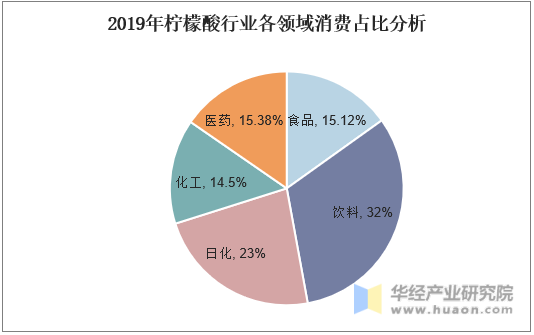

Citric acid products, as a regulator of acidity in food industry, are widely used in the manufacture of various beverages, soft drinks, wine, candy, snacks, biscuits, canned fruit juice, dairy products and food additives as animal feed. According to statistics, the downstream consumption of citric acid in 2019 accounted for the largest beverage sector, accounting for about 32%, followed by the daily chemical sector, accounting for 23%. At present, many kinds of starch materials such as dried yam, corn, cassava and rice can be fermented to produce citric acid in China, and the production of citric acid from corn is one of the mainstream production processes in China. China’s citric acid manufacturers are mainly concentrated in Shandong, Anhui and Jiangsu provinces, which are the main export provinces of China’s citric acid, accounting for 95% of the country’s total export volume. Among them, Shandong is the largest citric acid export province in China, accounting for 73% of the total export volume of citric acid in China.

Second, China’s overseas export of citric acid

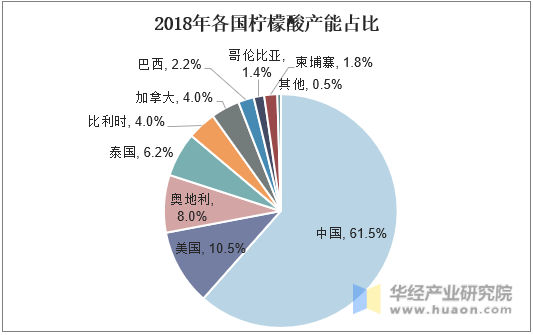

At present, the output of citric acid in China accounts for 61.5% of the global market and is in an absolute leading position. Main export object is still mainly in Asia and Europe, in 2008, the three major raw materials companies in the United States imposed trade remedy action, citric acid and citric acid in China launched a “double inverse” survey, a move that led to the citric acid industry in China was a great blow, makes our country citric acid slump in exports to the United States, abnormal loss is serious, Cause domestic citric acid to withdraw from American market almost completely. At present, ASEAN, India and EU are the main export markets of citric acid in China, and the annual growth rate of the export volume in these areas is about 5%. In particular, India and Japan have no local citric acid factories, so the demand for citric acid basically depends on imports from China (India’s imports of citric acid from China account for 99% of the country’s total imports in recent five years). The price advantage is the main advantage of China’s citric acid in the international market at the present stage. Compared with Thailand, the United States, the European Union, Colombia, Brazil and other countries, China’s citric acid export price has obvious advantages. According to the data of the General Administration of Customs, the unit price of China’s citric acid export is 847.18 USD/ton, which is far lower than the export price of the United States and the European Union above 2000 USD/ton, and has obvious advantages compared with Thailand and other Asian countries. Affected by the tightening of environmental protection policies, the domestic price of citric acid has recovered in the past two years, but there are still a number of new citric acid projects coming into production after 2020, so there is little room for price growth in the international market in the future.

The price advantage is the main advantage of China’s citric acid in the international market at the present stage. Compared with Thailand, the United States, the European Union, Colombia, Brazil and other countries, China’s citric acid export price has obvious advantages. According to the data of the General Administration of Customs, the unit price of China’s citric acid export is 847.18 USD/ton, which is far lower than the export price of the United States and the European Union above 2000 USD/ton, and has obvious advantages compared with Thailand and other Asian countries. Affected by the tightening of environmental protection policies, the domestic price of citric acid has recovered in the past two years, but there are still a number of new citric acid projects coming into production after 2020, so there is little room for price growth in the international market in the future.

Three, citric acid prices

At the present stage, the supply side of citric acid in the domestic market is under great pressure, mainly due to the weak demand for domestic drinks and the limited increase in the demand for food and daily chemicals. The overall performance of the market is weak, and there is still some consumption pressure. In particular, the rising purchase price of corn has led to the rapid growth of production costs of enterprises since the second half of 2020, and the profit space has been greatly squeezed. Considering the constant pressure of cost operation, most enterprises still maintain limited production. The data show that the production cost of citric acid enterprises in November 2020 was 5536.69 yuan/ton, with a sequential increase of 3.45% and a year-on-year increase of 22.25%.

Four, detergent has become a new market demand

In recent years, the domestic beverage industry market demand is sluggish, resulting in the overall domestic market demand for citric acid has not been a breakthrough growth for a long time. Detergent also as a large market demand for daily consumer goods, in recent years has gradually become an important downstream demand market for citric acid. Application of citric acid in the detergent industry more extensive, mainly the use of citric acid itself performance comparison is good, the application of chemical cleaning agent mainly affect the surface of the porcelain, alkaline solution and complex materials to China stronger corrosion, and citric acid after fusion and detergents, can improve the ability of clean. At present, many countries have promulgated the policy of banning phosphorus in detergents. Italy, Switzerland, Japan and the United States have successively required their countries to use detergents containing very low content of phosphate or phosphate-free detergents. Germany and Canada have also restricted the use of phosphate detergents. Citric acid and its derivatives, as environment-friendly products, will replace sodium tripolyphosphate and become the main raw materials of detergent in the future. At present, the production of detergent in China is basically stable at more than 10 million tons.

Post time: Oct-20-2021